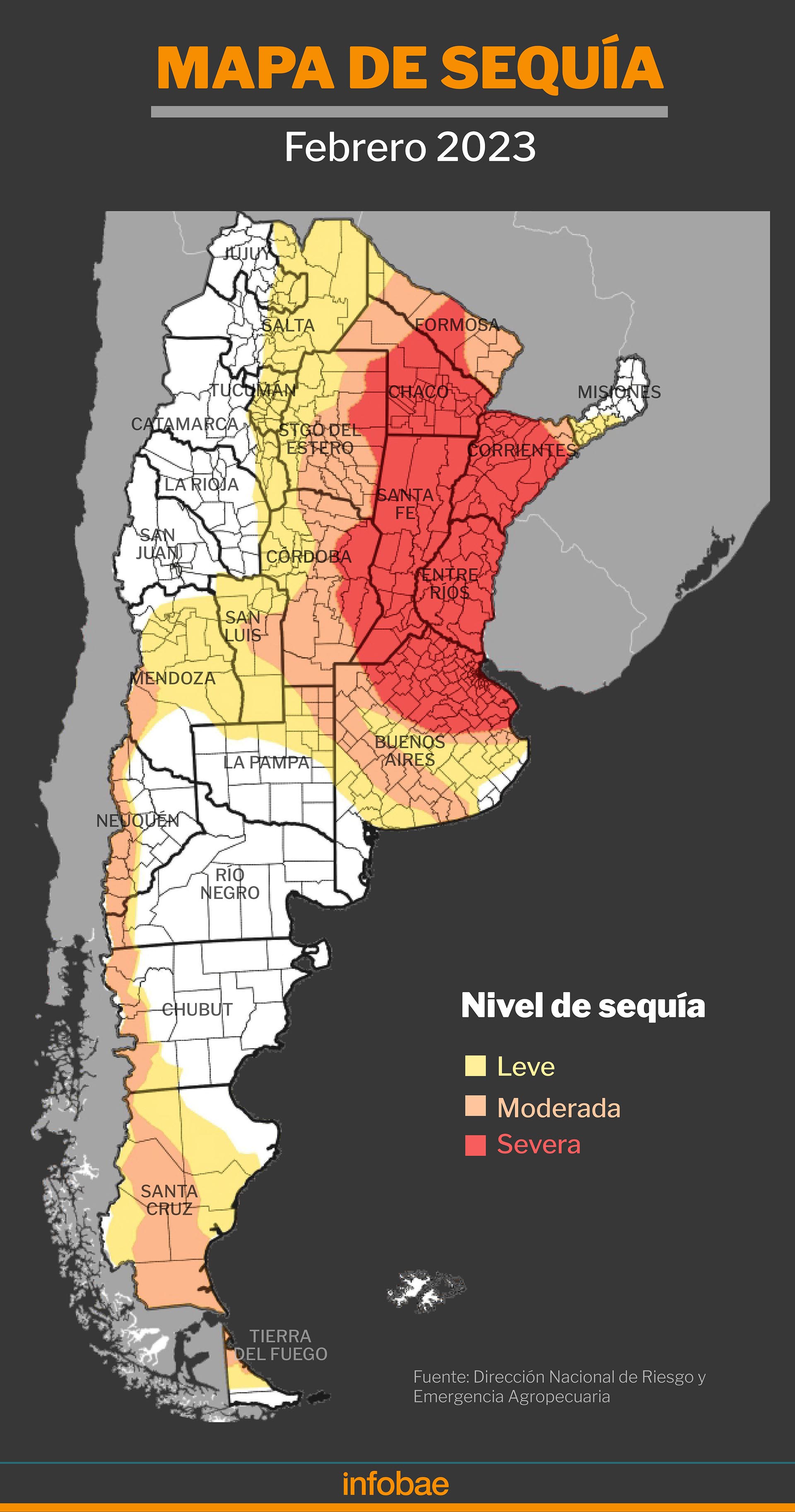

He field faces a very complex 2023. In the first place, it suffers the productive disaster in the grain agricultural campaign and the impact on livestock and regional economies generated by the extreme drought that still plagues a good part of the national territory. All this in the midst of a context of growing tension with the national government and in which the political and electoral campaigns for executive and legislative positions begin to take shape.

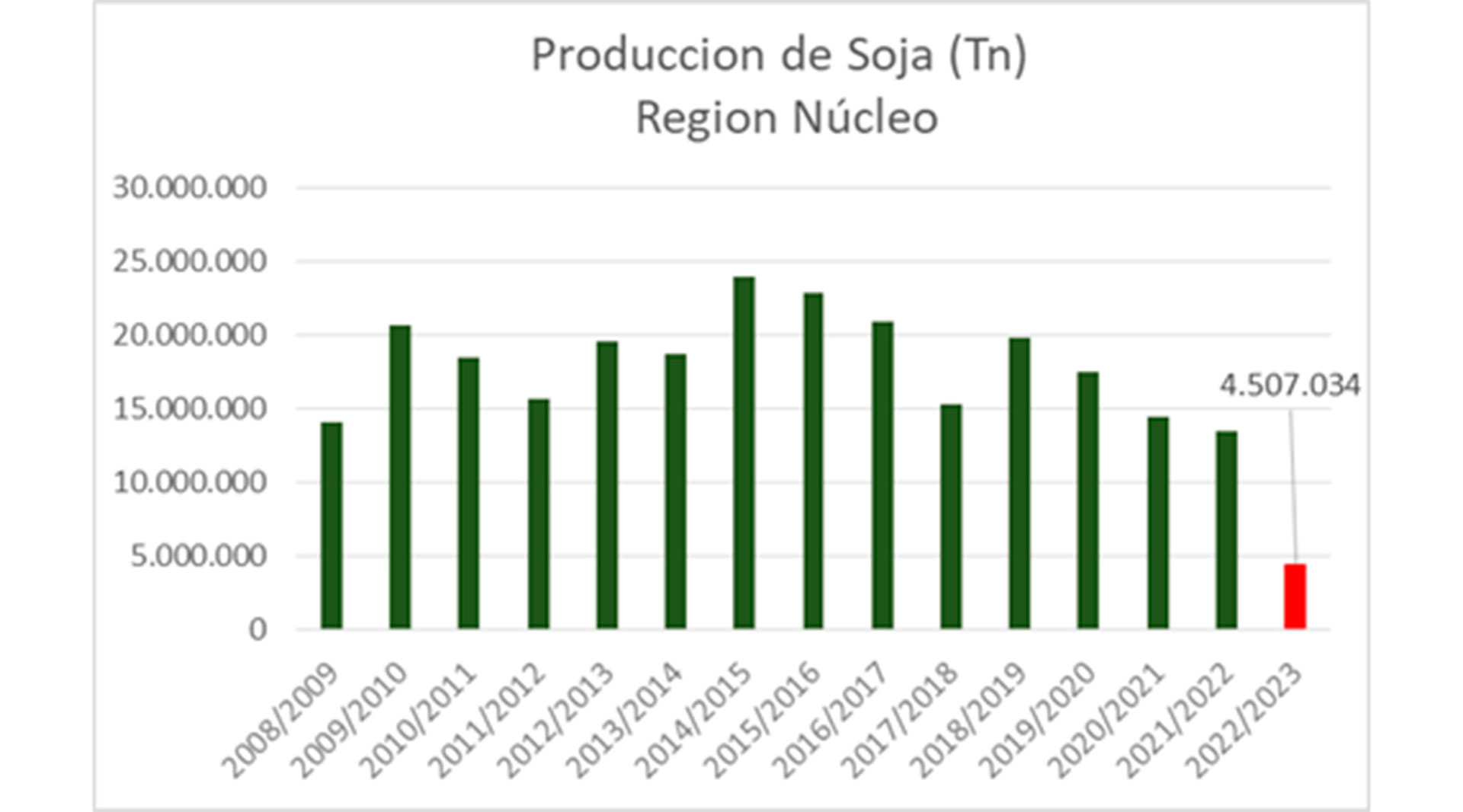

The productive panorama is critical and is the biggest problem that the sector will have to face during this year. Although the climatic phenomenon of The girl came to an end, the drought did not go away and the cuts in the harvest forecast continue. This week the Buenos Aires Grain Exchange (BCBA) adjusted downward, by four million tons, the soybean production estimate, up to 25 million tons, the worst mark in 23 years, just to cite an example.

For Charles Steiger, professor and director of the Master’s Degree in Agribusiness at the Austral University, 2023 “is going to be a very difficult year in every sense for the sector, with drought as the central issue.” The lack of rain was the main variable that led to the producer confidence index produced by that house of studies reaching the lowest levels in history.

Certain indices in the survey were also at all-time lows, such as the producer’s financial situation statement and present conditions. Producers rule out making investments at this time taking into account the current context, the specialist pointed out.

According to Steiger, with this scenario of successive cuts, with losses for the production sector estimated at USD 14,000 million, which reaches USD 19,000 million if related activities are taken into account, “the trustespecially at present, is at the lowest point in history” and the question that arises from this state of affairs is “how will the next campaign be financed, since generally what is harvested is planted, but that money is not there.

For this reason, Steiger states that “there are issues that should be implemented in this situation, such as lower the tax burden, which is something very complex, because the IMF is not going to let it go down. But the producer can also wait for another ‘soybean dollar’ to return or for an exchange unification to be implemented, which would be the only viable alternative without fiscal cost, but that would imply reviving the inflationary process”.

For the coming months, the specialist considered that “climatically, it will not be worse than it already is”, but regarding the political expectation of the sector, he maintained that “a change of government is expected and, as they are given things, is something that can happen. It is also expected that the agricultural policy will change, because the sector is the only source of genuine resources and reserves, because today we are on the floor”. These are the points that allow the index of future expectations that the entity builds, although it still remains in negative values, to have rebounded compared to previous measurements.

As Steiger previously said, one of the main stumbling blocks that the farm will also have to face is financing for the next wheat campaign, especially in this economic-political context. At the same time, producers will have to establish their strategy, not only paying attention to the weather, but also taking into account the electoral landscape.

The director of the consultancy AZ Group, Sebastian Salvarosaid that one of the first decisions that producers are making in the face of this complicated scenario, “is to seek a lot of financing to tackle the 2023/24 campaign and the logic is to borrow a lot to be able to pay for the bad campaign and open the door to the next cycle. ”.

But also, Salvaro remarked that another leg of the strategy that those producers and companies that can access financing will adopt is “to save as much as possible of what is harvested now for the end of the year. That is the logic: pay a lot of current account with money and not with grain to later be able to pay rent and wait for a movement in the exchange rates in the face of a new government. What they are trying to do is reach that moment with all the grain they can, which is going to be little because the harvest is going to be very bad.”

However, beyond the points raised above, the producer will also bet heavily on the wheat and barley campaign that begins in a few months and assured that “as many hectares as possible will be planted, weather permitting.” “We were measuring the intention to sow fine crops and it is very high, but it has to rain 250 millimeters. The intention per se is there and it is going to have a commercialization rate in relative terms that is much lower than in recent years,” Salvaro said.

“Today the expectation is that the harvest is going to happen with another government. That is heard repeatedly. As for the policy changes, they do not see a drop in withholdings, but it must be taken into account that when they are given a time horizon of low withholdings, a kind of predictability, it is good for the producer”, he concluded.

Precisely, the electoral expectation not only conditions the commercial strategy of the producers, but is also a variable that is analyzed in the increasingly tense relationship between the national government and the sector. In this sense, the director of the Synopsis consultancy, Lucas Romerostated that “the situation of the sector is particular and delicate because of what it is having to go through, for which reason for a bad relationship between the two, invites it to get even worse.”

However, Romero understands that a more aggressive sector is not seen in the protest or hinting at a more exposed deterioration in the relationship between the two, because the actions of the leadership “are colored by the expectations that are held for the future and, Since that of a change of government is so clear, it makes the sector wait”.

“Paradoxically, there is no more conflict because at some point the sector knows that this is over and is waiting to see what comes next. That does not mean that there is not a demand for attention and help. That will not be subject to waiting. The Government has always seen the countryside with an extractive vocation, but today agriculture asks the government for a willingness to contribute,” Romero explained.

But beyond the expectations of the sector and the relationship between the Executive and agriculture, the tension is also felt within the sector, especially with those producers who decided to “assume their own representation” and who maintain a critical position regarding the agricultural leadership. “This is happening on the field, not in a massive way, but there is a very angry sector that understands that you have to go a little further in exerting pressure to obtain a result. This occurs in a context where the electoral process begins to take place and not only the union leaders but also the producers begin to find an echo in politics that they do not find at another time,” said Romero and concluded: “The problem is to what extent the countryside can reach internal consensus and unify a program of conditions that demand from the next government what the margins should be to decide agricultural policy”.

Keep reading: