CARACAS.– In 10 days, Venezuela faces the elections presidential most transcendental in its recent history and with it a decisive stage of the economywhich will be marked by the uncertainty of the voting results and which could undermine economic growth expectations, forcing a forecast, according to analysts.

From July 28, election day, until January 2025, when the president is sworn in according to the norm, there will be six uncertain months, but those days until December place the economy in a “limbo”, “even if the opposition wins”, predicts economist Alejandro Grisanti, director of Ecoanalítica, a strategic planning consultancy in the current political context.

“It is difficult to see how 2024 will end, what the exchange rate position will be in those last five months of the year if Edmundo González Urrutia wins and the government is the one in power. It is a time of great uncertainty and it is not clear what can happen in those scenarios or, even, that fraud is suspected, although I do not see the uncertainty as much if the elections are postponed, which continues to be our main scenario,” says the consultant.

A recent study A current analysis prepared by Ecoanalítica and published in DIARIO LAS AMÉRCIAS, indicates that they see it as “very unlikely” that elections will be held on July 28 or that the regime will recognize its defeat and leave power. It indicates that despite a high turnout in the elections in which the opposition candidate Edmundo González would have the best chance, according to polls, the ruler and candidate Nicolás Maduro would resort to actions to remain, amidst the advantage.

This would lead to scenarios that create uncertainty in the economy and could undermine expectations of growth of more than 4% by the end of the year.

Uncertainty

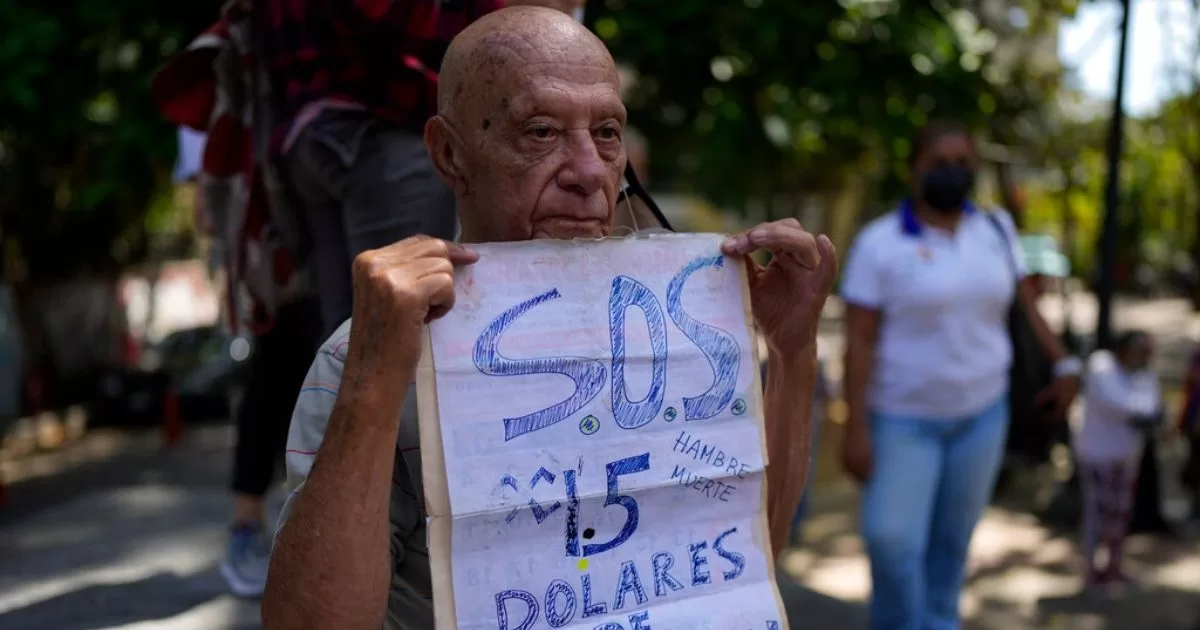

Venezuela is currently reporting timid economic growth amid a structural crisis, high debt and impoverishment of the population. In the face of this, the Maduro regime has maintained a certain exchange rate stability, according to reports from the consultancy firm.

“In Venezuela, many of the interventions (by the Central Bank) to reduce exchange rate volatility are made in cash with very few controls and with great incentives for corruption. One question I ask myself is how they would create incentives for corruption if in just two weeks, as it seems, the Maduro regime will possibly leave,” he warns.

Grisanti sees “the greatest uncertainty in the economy” in the next five months, after the presidential election, and raises two major political questions. “If the opposition wins, what can happen to the entire stabilization policy that has been carried out so far? And will the government that leads the country for six years (2025-2030) be recognized by the international community?”

Nicolás Maduro, elected in 2013 after the death of Hugo Chávez, was re-elected in 2018 for six more years in an election classified as unconstitutional, without the participation of the traditional opposition and with more than 50% abstention, so he did not have international recognition.

“One of the aspects that we see at Ecoanalítica is that it is very unlikely that a democratic celebration will continue on July 28 when the will of the Venezuelan voters is announced,” warns the consultant.

Three scenarios

The direction of the economy determined by the results poses three scenarios for the next six months, according to Grisanti:

1- Edmundo González, with majority of votes. With the change in the direction of the economy, a period of economic expansion begins – not readjustment – favoured by foreign investment. “There is no doubt that if he wins, he will be recognised by the international community, because the opposition has no capacity to commit fraud,” he says.

And he identifies three important aspects. First, a new government will be able to attract significant investments for the oil sector; second, the restructuring of foreign debt in the order of 160 billion dollars in the face of PDVSA’s default. “Any recovery of the oil sector needs to solve this problem with a restructuring program that manages to adapt this immense mass of liabilities of Maduro and Chavez, to make a cut and be able to pay according to the country’s ability to pay,” he said. And third, a reengineering of transfers to the most deprived sectors that somehow reactivate economic growth.

2- Maduro remains in power and “not be internationally unknown,” meaning that he could meet with and attract foreign investment, as well as go as head of state to multilateral organizations such as the IMF, to establish economic recovery programs and restructure foreign debt.

“This scenario, unlike the previous one with González, is limping in that it is very difficult to think that those who destroyed Venezuela and caused an accumulated fall in GDP from 2012 to 2019 of more than 80% will be the drivers of the country,” Grisanti notes. And, at the same time, he adds: “We see it as very unlikely that a new Maduro period will succeed in creating confidence to attract foreign investments and be able to have a restructuring of the debt and growth of the oil sector.”

3- Maduro remains unrecognizedas it has been since 2018, and get some kind of international investment, which “would lead to a dwarf economy”, without sources of growth and only with small enclave sectors that will grow, but in the end there will be nothing else. “From an economic point of view, the latter is the worst,” he notes.

Facing limbo

Faced with these scenarios, the expert believes that in order to attract the investments that the country needs in 2025, it is necessary that “whatever happens in the next two weeks” the government does not end up being unknown to the international community and that it remains so for the next six years.

“That would be one of the biggest problems to face for me. Let us remember that the 2018-2024 government was not openly recognized by the international community and that created a lot of uncertainty from the business point of view, the defense of assets and representation in the default in Venezuela.”

Given the complexity of the scenarios at the end of 2024, Grisanti advises that, given the stability that the dollar has experienced in the last 12 months in Venezuela, “hedging operations should be carried out, seeking refuge in safe currencies, in view of the election.”

(email protected)

Source: Interview with Alejandro Grisanti, from Ecoanalítica