He package of measures In response to the inflation data for April that the Ministry of Economy announced this Sunday, it will include a boost to the consumption financed in installments and one more detailed administration of trade, both internal and the operations that are made to and from the outside. They are part of the decisions that the economic team worked on this weekend and whose main determination is a new interest rate rise, which will impact the fixed terms and the Leliq issued by the Central Bank. The other macro components are more careful stewardship of financial dollars and fund management to bolster reserves.

Faced with a higher nominal value month by month, which can anticipate consumption decisions and also do it in installments, the Government will seek to push more purchases under this modality and for that it will make the price cheaper. Plan Now 12 for the consumer. As reported by the Ministry of Economy, starting tomorrow the cost of financing in twelve payments will be 9 percentage points lower at the level it currently has, which is 77.35% Nominal Annual Rate (TNA), according to information from the Ministry of Commerce. In this way, the TNA should become 68.35 percent.

That rate discount It will only run for products of national origin included in the financing program. The latest updated data shows that the Now 12 plan represents some 5.8 million monthly operationswith a value equivalent to $250,000 million. “It is a concrete benefit to merchants and companies,” they mentioned from the Palacio de Hacienda.

The installment purchase program includes operations in sectors such as cell phones, household appliances, clothing and footwear, furniture, construction materials, motorcycles, spare parts, books and stationery, toys, bicycles, glasses and contact lenses, lighting fixtures, perfumery, tourism and different services such as educational, personal care, repairs, installation of alarms, organization of events or funerals.

Among the stimulus measures for the sector of micro, small and medium-sized companies, Economy will implement a plan of tax relief for debt due as of April 30. The package will include plans for payment facilities to cancel tax obligations and social security contributions due for an amount $456,063 million.

The measure, they calculated, will benefit 656,121 taxpayersof which almost half (just over 48%) are Micro and Small Companies, 11.5% Medium and 31.2% are Small Taxpayers and Monotributistas.

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/KEDLGBHZW5B2XH5TCVXS6YVLXM.jpg%20420w,https://www.infobae.com/new-resizer/KCBCC_jsjAZktR2bdYX93B1INMs=/768x432/filters:format(webp):quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/KEDLGBHZW5B2XH5TCVXS6YVLXM.jpg%20768w,https://www.infobae.com/new-resizer/MrPFCp_-viHswVSIv-LvP1yZYG4=/992x558/filters:format(webp):quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/KEDLGBHZW5B2XH5TCVXS6YVLXM.jpg%20992w,https://www.infobae.com/new-resizer/ebtA1L91pEEiEnGRIhv0K2m-qNs=/1200x675/filters:format(webp):quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/KEDLGBHZW5B2XH5TCVXS6YVLXM.jpg%201200w,https://www.infobae.com/new-resizer/gAv7tkUkX29KCNTNwDGxXgLceyQ=/1440x810/filters:format(webp):quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/KEDLGBHZW5B2XH5TCVXS6YVLXM.jpg%201440w)

The main debts on which the relief will fall are Contributions and Contributions (37% of the relief) Earnings (18% of the total amount), VAT (3. 4%), Personal property (3%), Contributions and Contributions (37%).

The relief will include the forgiveness of imposed fines, supplementary charges for import or export taxes and liquidation of the taxes included in the procedure for the infractions, as well as their interests, in line with the Customs Code, and will also include the debt in dispute. administrative-judicial and that included in expired plans until the validity of the general resolution of the AFIP.

On the other hand, the relief will not allow the refinancing of current plans nor will it include the maturities of Profits and Personal Assets -of individuals and companies- of December 2022.

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/SO65DK3DQRBK7CJTI7VSRGFLWU.jpg%20420w,https://www.infobae.com/new-resizer/uJbDuVFnEDWhBM2mPRtak1kiY6E=/768x341/filters:format(webp):quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/SO65DK3DQRBK7CJTI7VSRGFLWU.jpg%20768w,https://www.infobae.com/new-resizer/S4_u68RZmWBw6NKLBBtaHle3Nww=/992x441/filters:format(webp):quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/SO65DK3DQRBK7CJTI7VSRGFLWU.jpg%20992w,https://www.infobae.com/new-resizer/Ir1ePaRZB4VwfLXrMSlHUjqK1RY=/1200x533/filters:format(webp):quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/SO65DK3DQRBK7CJTI7VSRGFLWU.jpg%201200w)

A specific part of the tax relief refers to the current plans for Micro, Small and Medium Enterprises (MiPymes) with the Badlar rate. It should be remembered that during the pandemic Law 27,653 extended the moratorium established in the Law of Social Solidarity and Productive Reactivation, from the beginning of the government of Alberto Fernandez.

The increase in the Badlar rate (currently at 70%) produced increases in payment plans that greatly affected MiPymes. As a relief, the AFIP will establish a wait for a proportion of the interest of the installments of the payment plans maturing from June to December 2023.

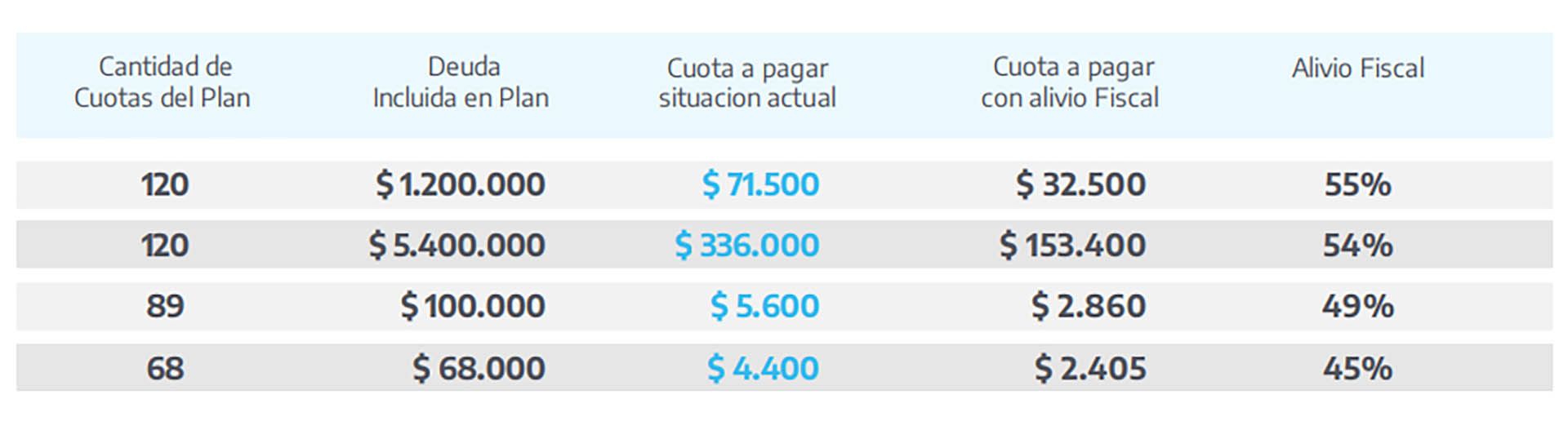

Economy even specified the amounts of debt, number of installments of this measure, which will average a tax relief of 50% in the value of the monthly installments of the payment plans of MiPymes

On the other hand, the Government will apply a more exhaustive control of the operations of internal and external tradeas reported by the Ministry of Economy as part of this package of measures after the inflation data for April, which was 8.4% and that raised the annual price rise to almost 109 percent. In this sense, the creation of the Unit for Monitoring, Traceability and Promotion of Trade Operations.

The new entity will have as its objective “monitor purchase and sale operations of goods and services in internal and external trade. Promote commercial operations fairly, avoiding dominant positions. check the traceability of the goods traded and the correct taxation at each stage. Guide the consumer by attending to the variables obtained in the monitoring process”, they considered from the economic team.

In this sense, it will be made up of “an executive area with a representative of each organization that composes it. The holders of the intervening jurisdictions will analyze the connected information on a daily basis and will order the necessary measures”. The public agencies that will form part of it will be the Secretary of Commerce, Production and Agriculture of the Ministry of Economy, together with AFIP, Customs, the Central Bank, the Superintendence of Insurance, the National Securities Commission and the Financial Information Unit ( FIU).

On the other hand, Economy decided to grant a new role to the Central Market, which will be enabled in the Import Registry and “before the abuse of companies by dominant position You will be able to directly import these products with Zero Tariff, creating a greater supply of products without intermediary costs”.

The objective, pointed out from the Palacio de Hacienda, is to “reduce the effective sale price to the public of fresh products (fruits, vegetables, vegetables, meat) and non-perishable dry goods (staple foods)”. It is about, they stressed, “defending the power of consumption of people.” The imported products will then be offered directly to the public and to local retail stores.

Another measure is the suspension of Canon Payment for 90 days to Central Market stallholders who comply with the maximum prices set by the Ministry of Commerce. In this way, and in response to the refusal of wholesalers and large companies, Chinese supermarkets and local stores could be supplied with a basket of products defined by the Ministry of Commerce, imported by the Central Market “for break price gouging that these companies carry out when supplying these local points of sale. This basket would be controlled by the Secretariat so that nearby businesses comply with the maximum sales prices ”, is the official explanation.

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/LSUGCFKCJY6KYKB2UBF2GN2CPE.jpg%20992w)

Another chapter of the attack on price increases will be the suspension of rights antidumping in branches “of diffused inputs”; that is, they affect a wide spectrum of industrial activities and have a high incidence on the production and price of food. The objective is to reduce the effective price of imports of certain inputs, promote competition in highly concentrated branches and reduce prices throughout the value chain,” they explained from the Palacio de Hacienda.

The instrument to do so will be a ministerial resolution suspending the application of Antidumping Duties due to “circumstances related to the general foreign trade policy and public interest.” This is an attribution granted to the minister by article 30 of decree 1393 of 2008 that regulated antidumping investigations in Argentina.

International trade manuals define dumping as a form of unfair competitionof a destructive nature, which consists of selling in a foreign market below the costs of the country of origin, behavior that may be motivated by the destruction of the local industry and as a cause by the support, with subsidies or other tools, of the states of companies that engage in dumping and “flood” foreign markets with their products.

Keep reading: