This relief varies by state or county. In Miami-Dade, the owner receives an indefinite discount of $50,000 on the taxable value of his home, with the condition that he resides in it, since he cannot have more than one property under that program.

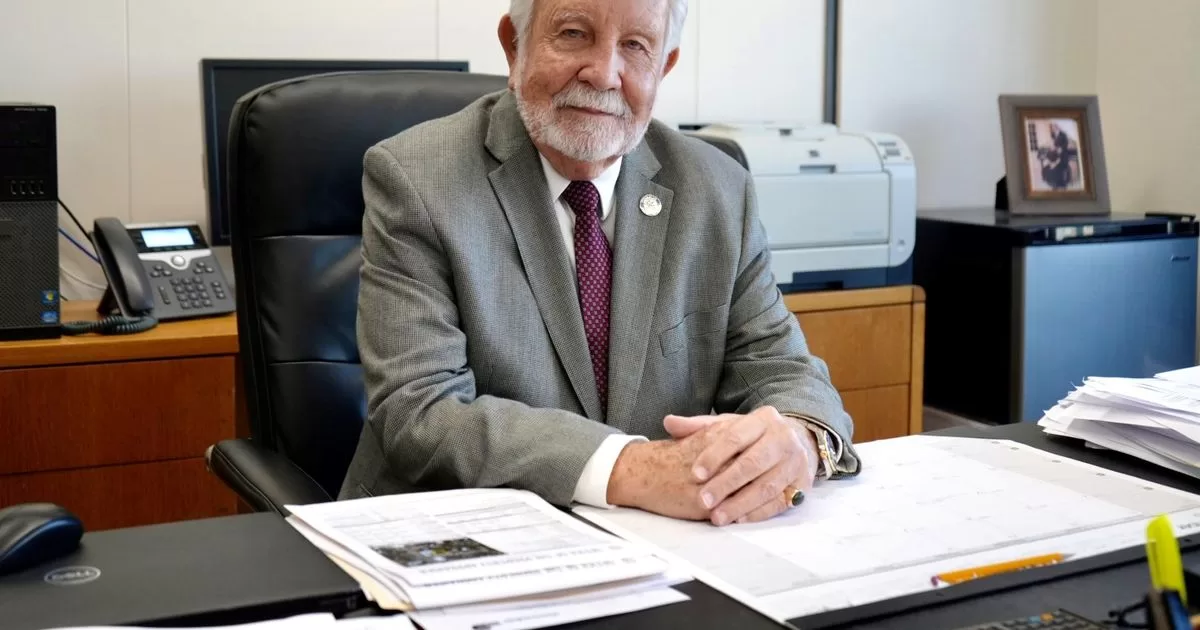

However, the number of cases of fraud regarding this benefit has been increasing, according to Miami-Dade property appraiser, Pedro García, who told DIARIO LAS AMÉRICAS that in the In the last 10 years, around $180 million in penalties have been imposed.

García explained how these contraventions are detected and also how a person can end up paying fines as high as the value of their home. “Friends and enemies” of the offender are the ones who denounce these irregularities, he said.

Likewise, the property appraiser referred to the millage reduction for the County’s 2023-2024 budget, which was approved at 1% when his office had proposed 3%, and the implications that such a measure would have.

In addition, he questioned the increase in taxes for homeowners in the county, which results from an increase in the budget authorized to the Miami-Dade School Board.

-How are the fraud rates against the Homestead tax exemption program?

The fraud has not stopped, and this for me is a mistake, because these people think they are very intelligent, and they are not. Who are the people who call us or send anonymous letters, because they do not have to sign anything or put their names, they are their same neighbors, their same friends, it can also be between a husband and wife who are divorcing. We have a huge number of people that we can detect, for example, there are those who have two Homestead exemptions, and how we can do it: with Social Security (identification). We also receive direct information about which cars are on a property, who are the people who are on a property with a driver’s license. We have a way to detect exactly if you live in one house or live in another.

-Is there any department or office specifically dedicated to prosecuting this type of crime?

We have a specific staff. When I started, there were two employees in our Fraud Investigation Department. At this moment, the group is made up of 26 people. That is, we are constantly trying to discover violators and receive all kinds of information. First the investigation is done, then we go to the property, and when this happens it is because we already have all the arguments to present ourselves to the person. If we later find that the case is not positive, then we completely cancel the entire investigation. It has happened to us, for example, with people who have gotten divorced and the husband has denounced his former wife and then we verify that there is no fraud. Of 100% of the correspondence and calls we have, plus the information we receive through the online system, 35% is true, the other 65% we discard because there are no reasons to continue the investigations. Something that is also important is that we have contact with other states that may have these exemptions and we ensure that a person does not have the exemption on two different properties.

-That means that a person cannot have two exemptions, including properties in other states.

Correct, you can only have an exemption on one property, including Puerto Rico. We are also in contact with the Florida counties that have this relief and when we find a suspicion, alarm bells immediately go off.

-How are the fraud statistics, what are the numbers?

In the last 10 years, we had about $180 million in liens or penalties that have been placed on people who commit fraud. This means we have about 18 million dollars annually. We can go back in our investigations up to 10 years, unlike the Internal Revenue that goes back up to three years. We can put 15% interest after penalties for non-payments. That is, from a minimum amount that the person saved, say, 2,000 or 3,000 dollars, the penalty can be much greater because it can be converted into 20,000, 30,000 or 40,000 dollars.

-How do these penalties operate?

These are civil cases, not criminal. On the property of the offender, we are going to present a “lean” (financial charge that can prevent the sale or transfer of the asset), and if the person does not have the means to pay the lien, the 15% fine continues to increase. When the person, for example, requests financing, the bank must first pay that amount to the County and they charge that to the owner. If that person sells the property, the first money from the sale goes to the County to cover that amount. Many people believe that they are selling their house for so much money and they may have a “lean”.

-Is it possible for a person to lose their property for committing fraud against that program?

No. We never take your property (the law prohibits this). The problem is that there comes a time when, for example, if now I owe $50,000 and next year I did not pay it and it increases by 15%, this means that I will have 15% above the $50,000. If the following year I do not pay again, I will have another 15% increase on the amount that had already increased, until there comes a moment that is like a drowning snowball and it may be that the penalty debt reaches a value that be almost similar to the value of your property. So, it is likely that the person thought that he has money for his property and it turns out that he has nothing.

-Are these cases frequent?

Very frequent. Unfortunately, there are many people who think they are very intelligent and are not. I reiterate: we have all the information and equipment to be able to prove that a person is committing fraud. A person’s friends or enemies help us a lot in these cases.

-How is the registration process progressing so that owners can receive this tax relief?

To receive this relief, all people have until March 1. If someone, for any reason, cannot apply before March 1, we will always have some exceptions. The only thing we ask of the person is that he has to give us some valid reason why he could not apply at that time, but we always look for a way to help him. Later he will receive a letter telling him that he has the exemption. This is a unique procedure. The person does not have to resubmit the application annually. If that person has her house and it is still where he lives, he does not have to apply for the exemption again.

-Are there many cases of homeowners who, without knowing it, could receive the benefits of this program and are not doing so?

There are many people. We hold conferences in the first few months every year so people don’t have to bother coming here (assessor’s office). Many people are unaware that they have the opportunity to have their property with a Homestead exemption and what this represents to them, and that is that the property will receive a $50,000 reduction in the ‘taxable’ value. That is a peace of mind because that person is not going to pay such high taxes. And that is the advantage that the exemption has for people who own property and reside there.

– But property taxes increase annually. However, his office has requested for several years that what is known as the millage be reduced, but the County has not granted his request.

Neither the mayor (Daniella Levine Cava), nor the commissioners. That’s a topic that bothered me. We had a huge opportunity to be able to offer that type of rebate to property owners, because the County’s revenue increased so much. Taxable value receipts last year in Miami-Dade were almost $48 billion. It was a gigantic opportunity to have offered 3% (the decrease was approved at 1%), which meant that people were not going to stop paying their taxes, but we were going to give them the advantage of paying less. Now the School Board has increased its budget in taxable value to $80.5 billion. That means that all of us are going to pay more taxes to the School Board. This is one of the things we have to address in Tallahassee. For this reason, on January 18 we will go to the state Capitol to address the issue before legislative discussions begin.

(email protected)

@danielcastrope