Starting in 2022, multiple analysts inside and outside the United States (US) have predicted a would be economic crisis in the three successive years.

The Biden administration, the federal institutions that support it and the large left-wing press in the United States seem to have agreed to do not mention or suggest a recessionwhen the reality that Americans suffer dictates the opposite.

The recognition of a economic recession would unleash panic on Wall Street, in international markets and among large companies and investors, after the banking crisis unleashed in 2023, among other causes, due to the high interests imposed by the Federal Reserve to stop the worst inflation in the country in the last five decades.

“The good news” in an election year

Regarding the political interestsfor the White House An officially confirmed recession would be the end of Biden’s reelection bid.

For these reasons, not even with a semester in the red did the government accept the term recession.

What woke up more doubts was that from that moment on, the growth of the Gross Domestic Product (GDP) shot up “upward” from one quarter to the next, and suddenly and as if by magic a media bombardment of supposed “good news” spread by Washington; in addition to a “nose reduction” of inflation that Americans still do not see and neither do their pockets.

The focus, on midterm elections in 2022 and in months prior to the November presidential elections of 2024, was aimed at clearing the tense atmosphere in the midst of a chaotic price escalation, the costly war in Ukraine, the lack of control on the southern border with a direct and indirect expenditure of more than 200 billion dollars per year from 2021; a record debt that today reaches 34 trillion dollars and an unprecedented industrial contraction along with other negative fundamental indicators.

All of the above has become a breeding ground for a similar wave of layoffs in 2024 – which has just begun – similar to that of the end of 2022 and the first two quarters of the previous year.

Various companies, including large technology companies, including banks, resumed the restructuring processes of their operations and expenses in 2024, which include massive layoffs.

Restructuring of banks after the crisis

The American financial group Citigroup, to which Citibank belongs, foresees cut 20,000 positions medium-term work to lower costs from $56.4 billion to $51 billion. But the figure is estimated to reach 60,000 fewer employees in 2026.

Citigroup and its financial services subsidiary Citibank make up the fourth most powerful bank in the US with $2.39 trillion in assets.

Despite profits, the accounts of large American banks were affected by the banking crisis.

JPMorgan Chasethe largest financial entity in the US, registered a drop in its net profit in the fourth quarter of the previous year $9.3 billion (-15%) next to Bank of America (-56%); while Citigroup lost $1.8 billion (-3%)

The deposit insurance agency or FDIC, recorded some 16.3 billion dollars in losses, after the bankruptcy of several US banks due to massive withdrawals, non-payments and low access to loans due to high interests.

Silicon Valley Bank (SVB) came under FDIC control and Silvergate Bank closed.

Additionally, Signature Bank and First Republic were sold in a rush move to New York Community Bank and JPMorgan Chase, respectively.

Low this panoramait is not ruled out that other banks begin restructuring processes y carry out layoffsperhaps not the largest ones like JP Morgan Chase, Bank of America and Wells Fargo that consolidated their power during the banking crisis.

At this time, federal regulators have requested to limit from $3 to $14 the fees charged to customers for not having a minimum balance in their accounts.

According to research conducted by Bankrate in August of last year, the average non-sufficient funds fee was $26.61, although some banks charge as much as $39.

Las New rules could strip billions of dollars in profits from biggest banks of the country, who were already preparing to respond to the proposal before the announcement.

The regulations, bankers explained, will lead to cuts in services and staff, statements that confirm that the biggest wave of layoffs in banks is yet to come.

Technology and layoffs

In the technology sector the situation could be worse under the fierce competition for Artificial Intelligence. Its use equates to less human labor.

Samsung, the main rival of Apple and its iPhone, launched its most recent Galaxy model, which this time incorporates artificial intelligence (AI).

The premium S24 Ultra, unveiled at an event in San Jose, California, has the ability to translate calls and text simultaneously in 13 languages and also offers unprecedented search capabilities, through a partnership with Google.

Google CEO Sundar Pichai warned employees that hundreds of layoffs are coming in the company, due to its new priorities related to artificial intelligence.

The tech giant laid off about 12,000 people this time last year, 6% of its workforce at the time.

Now, the company confirmed the elimination of “several hundred” positions from its global advertising team, but left open the possibility of additional reductions in the coming months.

Google had already announced days before the departure of hundreds of other employees of your hardware, voice assistance and engineering teams.

Microsoft decided to eradicate 1,900 jobs, 8% of its staff, from its entertainment division at a time when it consolidates the purchase of the maker of the popular video game “Call of Duty”, Activision Blizzard.

Video game developer Riot Games, responsible for the popular “League of Legends,” will cut 11% of its workforce.

Apple, which was also a protagonist in the wave of layoffs in 2023, faces a judgment of the Supreme Court of the United States that considerably reduces control over its lucrative application store for iPhones.

The court order would deprive to one of the most profitable companies in the world of billions of dollars of revenue, after ceasing to be the main driver of its application store on more than 1 billion iPhone phones because it was considered unfair competition.

The decline in profits will inevitably translate into layoffs due to cost cuts.

Retailers and large manufacturers

Amazon said will eliminate hundreds of positions in the Prime Video and MGM Studios divisions and two of their companies, Audible — an online audiobook and podcast service — and the streaming platform Twitch will lay off, respectively, 5% of their staff and more than 500 workers.

Spotify, Microsoft, Meta and IBM advanced similar measures recently.

The internet retailer eBay Inc. will leave 1,000 people without jobs, 9% of its full-time workforce, because the number of employees and costs have outpaced its growth in a slowing economy. This is the latest mass layoff in the technology sector made public so far.

The company will also reduce the number of “contracts we have within our alternating workforce in the coming months,” CEO Jamie Iannone explained.

Due to economic results, other large companies are lined up at the center of this new wave.

American industrial conglomerate General Electric (GE) reported a lower net profit in the fourth quarter of 2023.

According to the company, the net profit was 28% lower compared to the same period of the previous year. The firm attributes the data to unfavorable tax impacts.

The American industrial giant is immersed in a major restructuring that will lead to a division of the company into three independent entities, all publicly traded.

Meanwhile, the American electric vehicle manufacturer Tesla obtained results below expectations for the fourth quarter, affected by a decrease in the sales price of its vehicles.

Net income closed 2023 with a drop of 39%, compared to the same quarter in 2022.

Tesla also warned that the pace of sales growth could be “markedly lower” this year.

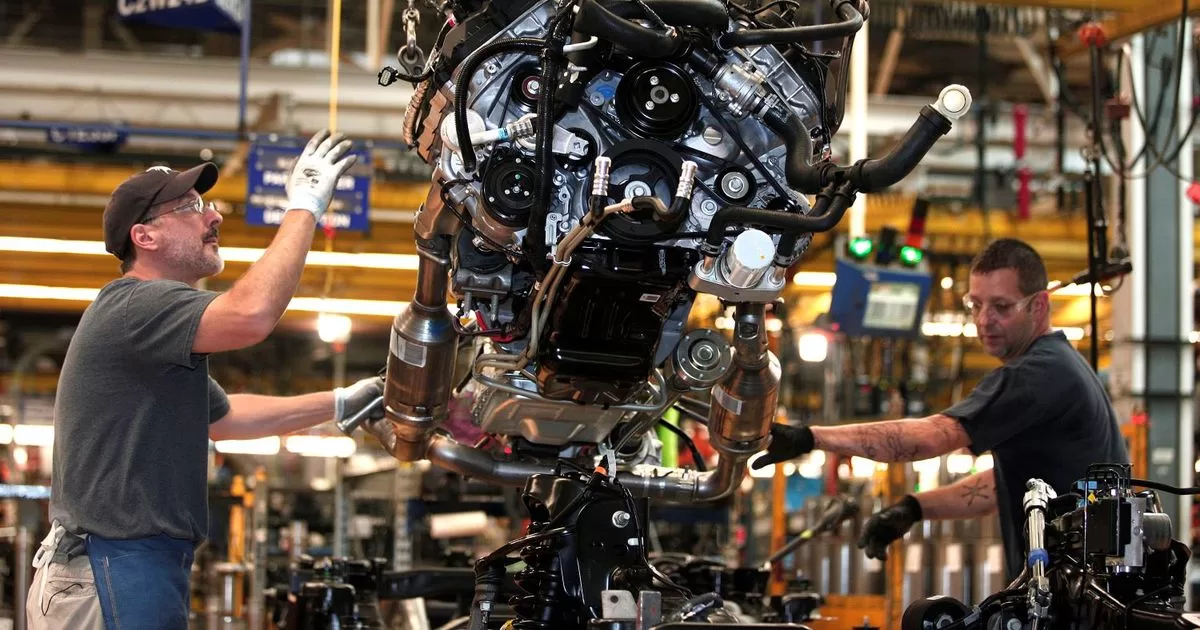

Ford will firefor its part, 1,400 employees at its plant in Dearborn, Detroit, where electric trucks are manufactured. ford will reduce production by half of the electric F-150s.

A strike Six-week strike by UAW auto workers reduced Ford sales by about 100,000 vehicles and It cost the company $1.7 billion. in lost profits, the automaker said in a recent report.

Los additional costs of the labor agreement in force for the next four years and eight months will add 8.8 billion dollars until the end of the contract

After close 20 stores in 14 states Over the past year, Walmart will let go of two large stores in California in February.

RiteAide is in the process of closing more than 140 stores this year, as are CVS pharmacies that conclude the elimination of 900 establishmentswhile Walgreens plans to eliminate 150 stores before August.

BigLots already referred to the liquidation of dozens of commercial premises in New York, North Carolina and Illinois. But the list of companies with forecast closures and layoffs in 2024 is almost endless.

(email protected)

Source: With information from AP, AFP and other sources.