The price of the blue dollar jumped to $397 on Tuesday and touched another nominal all-time high. What experts say based on other historical leaps

By Mariano Jaimovich

28/03/2023 – 18,05hs

He blue dollar took a new leap and hit a new price ceiling at $397. So it opens a debate among economists regarding whether it is “expensive or cheap” the US banknote in the informal exchange market.

One thing to keep in mind is that with this increase of 7 pesos this Tuesday, in the accumulated value of March, its value increased by 5.87%. That is, a percentage that is below the estimated inflation for the entire current month, which would be close to 7%..

In addition, the increase in the price of blue in the first 28 days of the current month is very similar to the theoretical yield of a traditional fixed term, which is located around 5.85% for that same period. Therefore, although it is “scary” that the informal dollar has reached the current reference, when comparing it historically it can be said that it is very far from its ceiling .

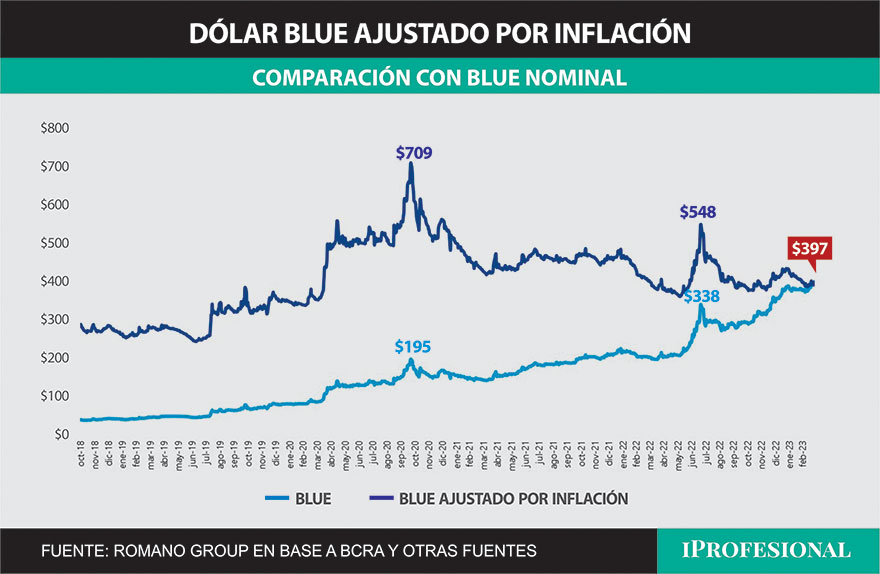

“Its nominal value is $397, but in real terms we are very far from what it reached on average during the administration of Alberto Fernández which, adjusted for inflation, today it throws a blue of $442. That is to say, before it was paying more expensive, and with the same logic it is not surprising, “he tells iProfessional Salvador Vitelli, Romano Group economist.

In fact, this expert graphs that when in October 2020 the informal bill jumped to $195, today would be equivalent to having a blue of $703 in real terms.

And if we think of the price of $334 in July 2022 when former Economy Minister Martín Guzmán resigned and another jump was generated, we would already be talking about a free dollar over $500.

The price of the blue dollar adjusted to current values for inflation shows how much the peaks it had years ago are equivalent to today.

Blue dollar price in sight

In short, for experts the informal dollar price is below, in real termsto the value recorded in periods of stress in recent years.

He blue of $397, in real terms, According to a survey by Vitelli, it is located:

- $12 below the 2023 average.

- $16 below the 2022 and 2023 average.

- $37 below average 2021 to present.

- $49 below the average of Alberto Fernández’s management.

“From a theoretical parity, it can be said that the blue is expensive, but given the important macroeconomic imbalances, particularly from the monetary point of view, its price probably has more to go. In real terms, it lagged well behind inflation. That is, should be above $500 to tie it to 2021-2022 inflation,” he indicates to iProfessional Fernando Baer, economist at Quantum, which is Daniel Marx’s consultancy.

Although it clarifies that the different price evolutions are “loaded” with a lot of volatility because it depends a lot on confidence, relative prices in general, an economic program, political credibility, among other relevant issues.

Likewise, it is considered that the informal square operates a “bounded” volume, Therefore, any relevant transaction that is carried out generates a change in value.

For his part, Andres Salinaseconomist and researcher at the University of La Matanza, maintains: “A blue above $390 is already a price that is more similar to the real one, that is, taking inflation into account. So far this month it has risen more than 5%, while financial ones have risen around 7%. For this reason, the blue is the freest dollar of all, and when the financial markets are overheated, people usually react by going to the informal market.”

Now, clarify that in the year the rise is still less than inflation, so “it still has room to go up. The speed will depend on the announcements of the Government and its repercussion and interpretation in the markets”.