The “temporary advances” with which the Central Bank (BCRA) helped the National Treasury for $130,000 million on Wednesday, March 22, drew the attention of those who follow the government’s financial moves. This type of progress has not occurred since the confusion and stampede that in mid-2022 marked the last month of management of Martin Guzman and the short passage of Silvina Batakis for Economy.

Since that time, the BCRA had not passed “profits” to the Economy either, which allowed it to comply with the 2022 annual assistance limit of the agreement with the IMF. That’s why Quantum consultancy, which heads Daniel Marx, Informal adviser to the Treasury on debt and credit matters, dedicated his last report to “ways of providing financing in pesos to the National Treasury.”

The reissue of the “advances”, he says, does not exceed the limits of the first quarter of 2023 ($139.3 billion), “but it is a manifestation of the difficulties that the Government has to finance its cash needs in pesos” The Treasury can be financed in pesos , directly or indirectly, through the withdrawal of debt securities from the market “to make room for new financing” and, now, with the sale of securities in dollars in the secondary market, to facilitate the sale of new securities.

In the first case, it is the BCRA that buys the bonds in pesos in the secondary market, generating the necessary liquidity for new subscriptions of Treasury securities. In the second, liquidity is generated via the sale of Bonares from the Sustainability Guarantee Fund (FGS), of the Anses) and the subsequent subscription of Treasury securities in pesos, Quantum describes.

This is how he explains the most recent official announcement to exchange titles in pesos for bonds in dollars. “On the one hand, the BCRA buys securities in pesos in the market and, on the other, national public sector organizations, mainly the FGS, sell their securities in dollars against pesos. These actions, which might seem contradictory when considering the consolidated national public sector, are not,” says the report, after describing the limit that had been reached by mid-2022.

Since then, what was direct assistance has become indirect: the BCRA buys debt in pesos in the secondary market; it does not transfer it directly, but it creates a space for the demand for new Treasury debt issues, which takes advantage of the reduction in the stock of maturities in the hands of private creditors, although this market also has more public debt in pesos and “shows signs of saturation”.

in a sort of raccount that denies the “patriotic” departure of Guzmán, the report recalls that in June and July 2022 the BCRA bought debt from the private sector in the secondary market for $1.26 trillion, “result of the sales of sovereign bonds by the private sector and the redemption of shares of mutual funds”. Disarmament that -initiated by a fund managed by the BNA on behalf of Enarsa- had brought the exchange rate gap from 80 to 150% and an increase in deposits in pesos by the private sector in banks, which increased by 11% in just 30 days.

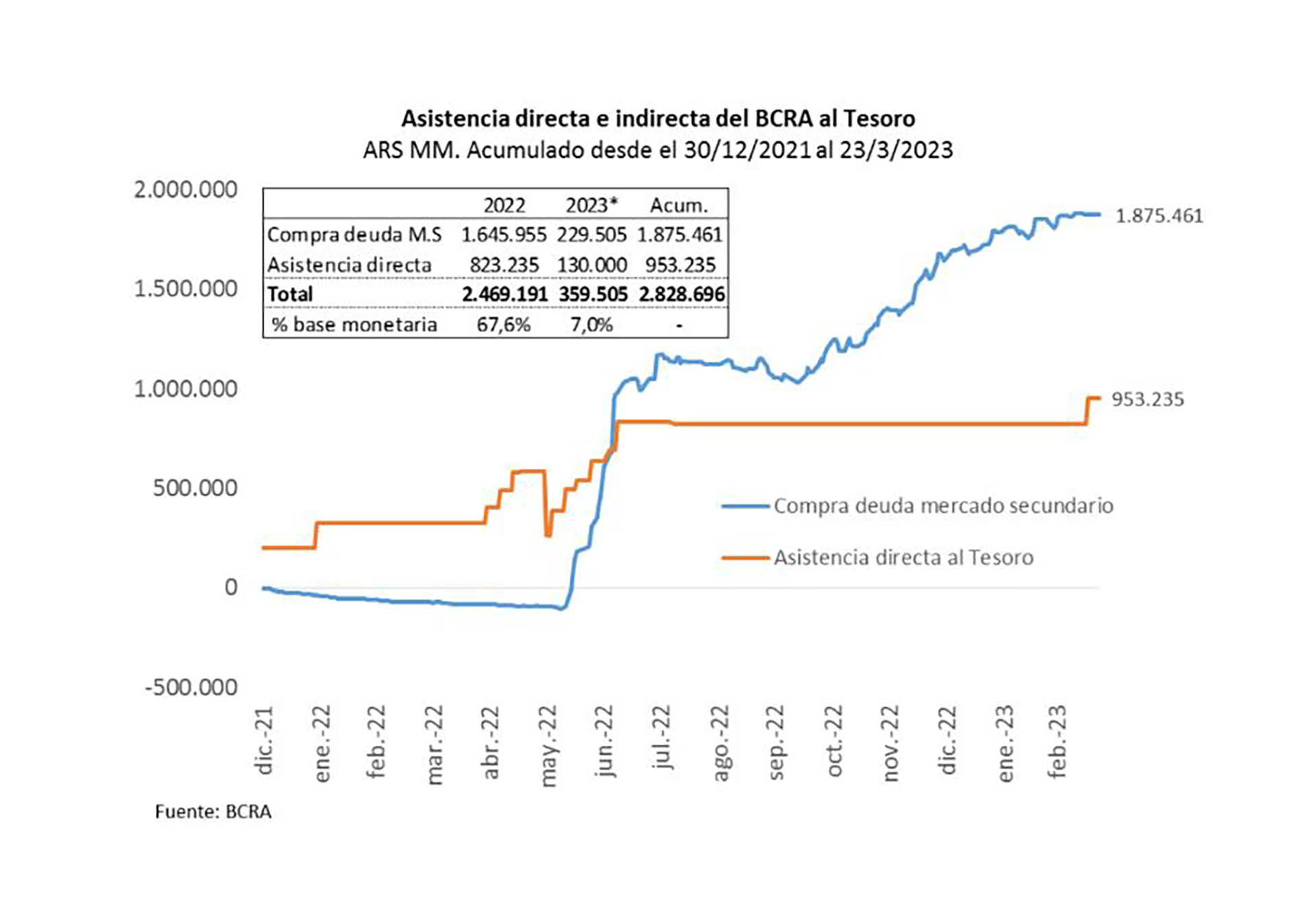

Due to reaching such an extreme situation, in 2022 the assistance in pesos from the Central to the Treasury was $2.5 trillion, equivalent to 68% of the monetary base and 2.7% of GDP, two-thirds through bond purchases that took out Guzmán del horno and a third directly: advances and transfer of “profits”. Even so, the former minister knew how to accuse the Central of not collaborating well with his management.

In 2023, the situation is different, until now. As of March 23, indirect assistance was only $229,505 million and direct assistance was the aforementioned $130,000 million. Added together they give only 7% of the monetary base. And in the face of tensions in the debt market, Massa adopted a different path from Guzmán, who burdened the BCRA. First, the March 9 debt swap eased second-quarter maturities by recharging them in February, April, and October 2024, but was constrained by low private participation, which according to Quantum “reflects policy uncertainty.” of public indebtedness before the change of government”.

It was then that Decree 164/2023 was used, which requires the sale of Treasury debt in dollars (Bonars) in the hands of State agencies, to subscribe with the resources raised dual titles (they pay the maximum between inflation and variation of the official dollar). , thus generating more financing in pesos to the Treasury from the public sector itself “to cover the gap due to the debt that the private sector eventually does not renew and also to finance the fiscal deficit higher than expected a few months ago.”

It is a large pool of financing: the consultancy calculates that the holdings of Bonares of public organizations, including the FGS, reaches USD 15.7 billion.

The Central, with everything, will continue playing. His task will be to support the debt market in pesos by buying securities sold by the private sector and making it easier for banks to reduce their holdings of Leliqs to buy Bonares sold by public bodies. In addition, says Quantum, “it will continue to have to make efforts to absorb the pesos that expand the monetary base for that reason.”

A whole pass of hands to prevent the coin from getting out of hand. As of March 23, the report concludes, the main factor for the expansion of the monetary base was the payment of interest on “remunerated liabilities” (debt at interest, to “absorb” liquidity) from the Central Bank, already at $1.9 trillion (millions of millions), which should have been offset with Leliqs and Passes, whose stock amounts to $12.1 trillion, 10% of GDP.

After describing the difference with the way in which they proceeded under Guzmán, Qauntum concludes by warning that, from the monetary point of view, “the eventual sale of Bonares would be expansive (and inflationary) if the pesos used to buy them were issued by the BCRA or if the banks decide to cancel positions in Leliqs or Pases to do so”.

Financial alchemy has its limits.

Keep reading: