Uncertainty is the order of the day. The pre-electoral scenario was anticipated in the preparation of lists for the PASO. There are plenty of economic fundamentals to analyze the evolution of inflation, devaluation of the peso against the dollar in its parallel listing, external restriction and lack of reserves in the Central Bank. He was joined by politicians.

Let’s review the economics and how the current one is transparent uncertainty. Precarious increase of only 300 basic points in the interest rate compared to inflation in March 2023 that rose to 7.7%, greater issuance of pesos to close the fiscal deficit with a drop in collection in real terms of 8.2 % in April 2023 and more debt placement in the local market, currency run that led the parallel dollar to touch $500 and minimum income of dollars to the BCRA coffers for the Soybean Dollar 3.0.

The intervention in recent days on the financial wheels on the parallel dollars tries to anchor expectations (In addition to regulations by the National Securities Commission to prevent the purchase of bonds). The reservations international are playing historic lows. The government while looking to move forward with a “Caipirinha” Swap version that adds to the Chinese one for commercial transactions with Brazil.

What has happened to our savings decisions in recent years? If we take as a parameter the fixed term from 2019 the value of the interest rate was not enough to exceed inflation for each period on an annual basis.

By 2023, the trend is no better as the TNA (nominal annual rate) for fixed terms is 91% and the inflation projected by the Market Expectation Survey (REM) is 126 percent.

Saving in pesos, a constant loss

If we accumulate inflation from January 2019 to April 2023 it was 648% while the fixed-term interest rate accumulated 512%. Saving in pesos has been a loss.

To the macroeconomic uncertainty is added the policy facing the elections. If we evaluate the value of the dollar today for each presidential term, we will see that the Argentine economy is a permanent “loop”.

In the 2003 elections for December of that year the value of the dollar at today’s values was $553, while for March 2004 it continued with its firm position at a value of 505 pesos.

With a fiscal and commercial surplus in 2007, the value of the dollar today was $334 for that year’s elections. Between 2011 and 2015 something very particular happened. The exchange rate appreciated until the mandate was delivered in December 2015 with negative net reserves in the Central Bank’s coffers. The value of the dollar today for the 2011 election was $210 and for 2015 it was $250 as a result of a previous devaluation in 2014. The devaluation of the peso against the dollar in the Cambiemos administration, which was very stressful, would be of a value of the dollar today of 376 pesos.

The current political context marked by a strong polarization of society towards the result of the future election shows in the price of the dollar the temperature of the crisis in its price that came to border 500 per dollar.

Now, if we continue looking at the series in time, we will observe that as election periods approach the value of the dollar increases, and we see for example that for December 2022 the value of the dollar adjusted to the inflation data is $421. In other words, the current exchange rate in its parallel price marks the border of the present and future uncertainty.

Go to the dollar, flee from the peso

There is no doubt that The dollar is one of the main monetary assets where the ordinary citizen usually takes refuge in the midst of recurring inflationary crises that crosses the country. Drop the weight. Not only does it take refuge in the dollar, but it run away from the weight

That is, it increases the speed of weight circulation. The formula of the quantity theory of money is at its best in the current context. M x V = P x T. M is the quantity of money, V is the rate at which money flows around the economy, P is the price level, and T is the number of transactions. If V (velocity) and T (number of transactions) are stable, then control of the money supply guarantees control of inflation.

This is precisely what is not happening today. Both are unstable and their level of variation is growing. Quantitative easing increases M (amount of money), so if V is fixed (velocity), it will push up P (price level) or T (number of transactions) or both. Despite the fact that the low money supply in April 2023 compared to April 2022, the fall in the demand for money accelerated, which acts on the upward price variation.

The purchasing power of the $1,000 bill collapses

The banknote with the highest nominal value offered by the BCRA is the $1,000 bill, which, since its inception in November 2017, adjusted for inflation it has a value of $38. Having pesos as a means of saving is only a “desahorro” in time. The use of weight over time implies that the “weights burn in the hands”. The government prints them in more quantities to the point that it has to import them from the mint of other countries.

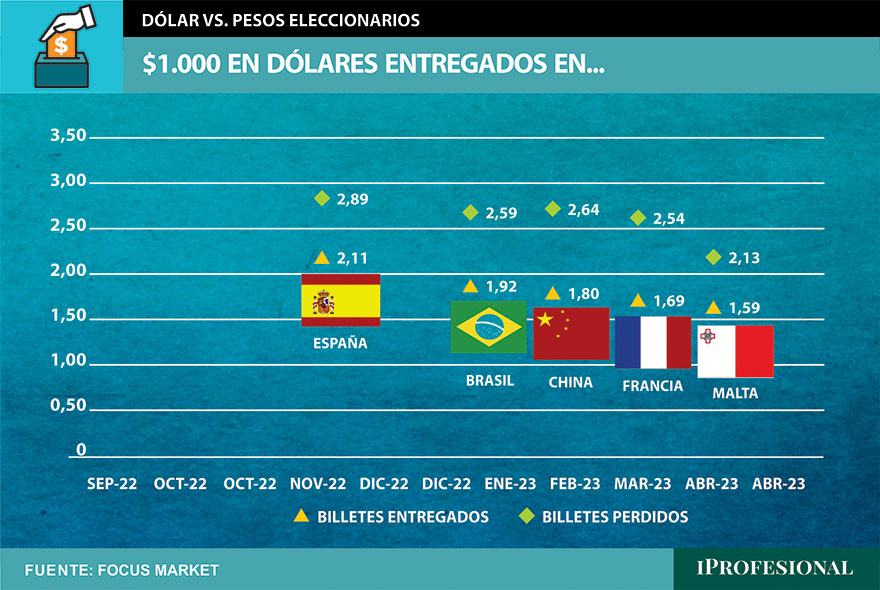

In this sense, our country is importing banknotes from 5 different countries: Spain, Brazil, France, Malta and China, the issue is that the delay in printing the $1,000 bill takes so long that, for example, $1,000 ordered in Spain in December 2023 for US$2.89 with delivery in April 2023 will end worth in its delivery u$s2.11. $1,000 ordered to Brazil for US$2.59 in January 2023 with delivery in May 2023 will be worth US$1.92. $1,000 orders to China for $2.64 February 2023 with delivery in June 2023 (China) will be worth $1.80. $1,000 ordered from France in March 2023 worth $2.54 with delivery in July 2023 will be worth $1.69 and $1,000 ordered from Malta in April 2023 with delivery in August 2023 will be worth $1.59.

We import with dollars that we lack, pesos that we have left over from 5 countries on 3 continents. We import pesos that will be worth less in the future with dollars that will be worth more in the future due to their scarcity. The world upside down.

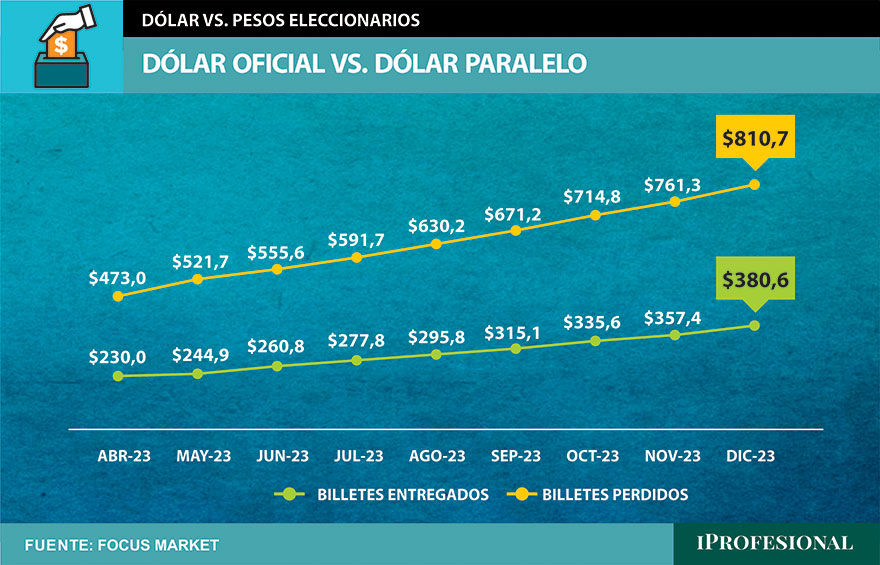

To keep pesos in the pocket of each Argentine is to lose strong value over time. The projected dollar series implies that maintaining the current exchange gap of more than 100% with the official exchange rate at the end of the year, the value of the parallel dollar will end up being $810 per dollar.

Wisdom is the daughter of experience. We are wiser. We know what “politicians” do when they promise in the elections and we know what they produce when they lie about what they promised once they have to carry it out. We know that the Argentine peso is the result of that farce taken to the polls. We know that when the dollar rises it is because the peso loses value. We know that the coin is a reflection of each of the faces of both political and economic decisions. We know that the problem is not the debt but the lack of a solid plan after its restructuring with private creditors and the IMF.

If we know why when we go to vote we don’t change it? Maybe Javier Miley is a result of having tried to change the policy to improve the currency and the society tired of invalid promises to improve the social and economic well-being in our country even think that leaving the currency behind is the best option before giving another chance to the traditional politics so that it continues to sink it.

Perhaps the opposition of Juntos por el Cambio lacks a clear and precise plan of how to break the current deterioration of the currency. On the part of the ruling party, a shock reversal of the deterioration current marginal in which we are immersed.

Each one who flips a coin, but will see that There are no longer 2 faces but 3 options to choose the destination of the pockets and currency of the Argentines.