Washington.- In 2008, an impending collapse of the banking system consumed Congress before lawmakers delivered a bailout. Three years later, a debt-limit crisis engulfed Washington, leading to a series of spending cuts after a dangerous brush with default and a first downgrade in the nation’s credit rating.

Now, concerns about the stability of the banking system and stalemate over raising the debt limit are simultaneously sucking up capital, adding to an already high level of financial anxiety as two economic challenges Congress has experienced before become intertwined.

“The stakes are high when it comes to what amounts to an economic double jeopardy,” said Sen. Ron Wyden, D-Ore. and chairman of the Senate Finance Committee. “The messages it sends to the economy and to the public regarding banking and the full faith and credit of the United States, have no more consequences than that.”

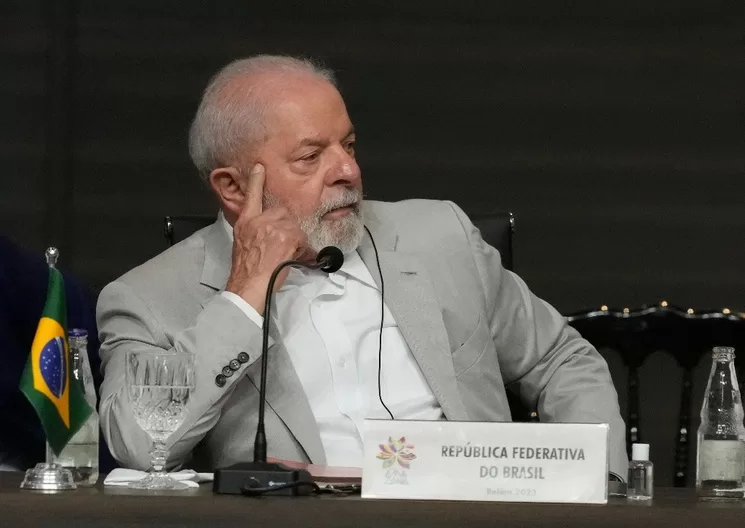

Republicans and Democrats alike acknowledge that it’s a terrifying case of déjà vu times two. But they diverge sharply on how recent bank failures, and uncertainty about how Congress should respond to them, if at all, will influence the debt-ceiling fight later this summer.

At their just-concluded retreat in Florida, House Republicans said instability in the banking system should strengthen their position in the upcoming debt-limit showdown. They argued that a Democrat-led spending spree spurred inflation, forced interest rates up and left a precarious situation for all but the biggest banks. For them, the clear answer remains deep spending cuts, and they say they will keep insisting on cuts before making any move to raise the debt ceiling.

“That should wake everyone up,” Chairman Kevin McCarthy, a California Republican, told reporters Tuesday when asked about the intersection of bank stability and the debt limit. Why are we in crisis? Because the government spent too much and created inflation.”