The Supreme Court is expected to rule on the Biden administration’s student loan forgiveness plan this month. That decision will play a role in shaping the financial future of 40 million Americans.

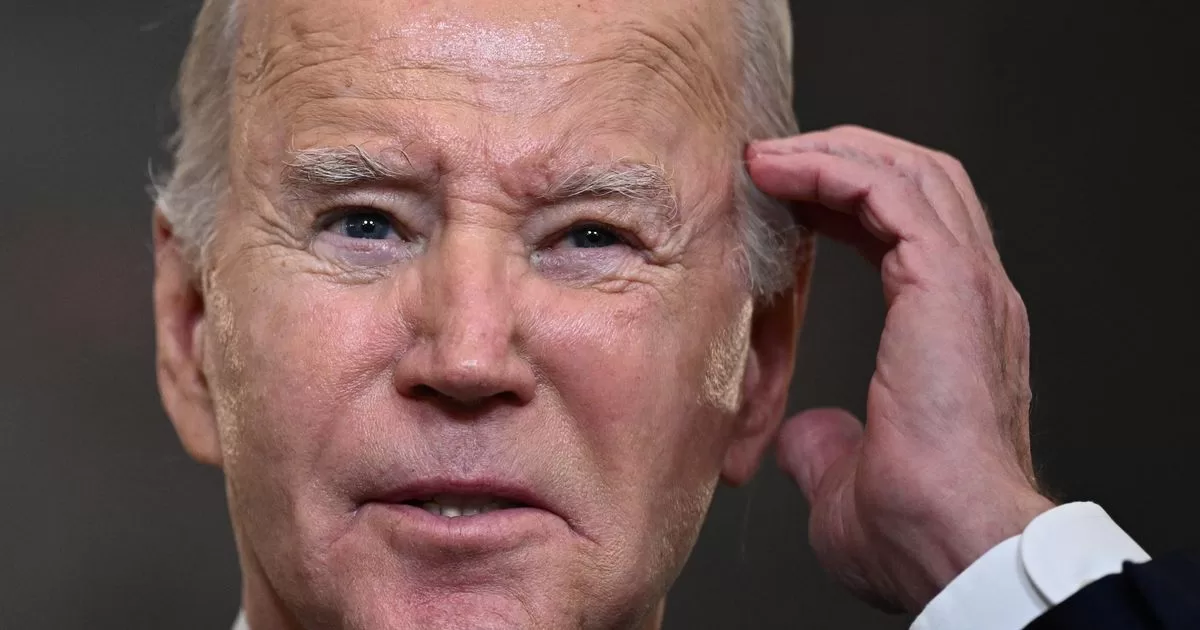

If the judges approve President Joe Biden’s relief, many borrowers will have $20,000 of their student debt immediately canceled if they received a Pell Grant in college, a type of aid available to low-income families, and up to $10,000 if they don’t. .

Some 14 million people would exit the plan without debt as students, which could make it easier for them to buy a first home, for example, start a family or open a business.

“The decision could be life-changing,” said Corey Shirey, 28, who is studying to be a pastor in Oklahoma and owes about $25,000.

Richelle Brooks, a single mom from Los Angeles who at one point had a monthly student loan payment of up to $1,200, said she was tied to her phone all of June.

“Waiting to find out whether or not it will pass is distressing at best, debilitating at worst,” said Brooks, 35.

Here’s what we know about the Supreme Court’s deliberation on the plan, as of now.

1. A DECISION IS EXPECTED BEFORE JULY

Borrowers shouldn’t be stuck waiting for judges much longer.

The ruling from the highest judicial forum should come in early July, before its term ends for the summer recess, said higher education expert Mark Kantrowitz.

“The court is likely to issue a decision before the end of June, probably on a Thursday,” Kantrowitz said, noting that that was the day of the week that the justices had recently been posting their opinions.

You will be able to read the ruling on the Supreme Court’s website, probably sometime on the morning of the decision day.

2. THE PRESIDENTIAL POWER TO CANCEL THE DEBT

With an estimated cost of around $400 billion, Biden’s plan to forgive student debt is one of the most expensive executive actions in history. The judges are likely to be examining whether or not the president has the power to implement such a radical policy.

The Biden administration insists it is acting within the law, pointing out that the 2003 Heroes Act gives the US secretary of education the authority to make changes to the federal student loan system during national emergencies. The country was operating under an emergency declaration due to COVID-19 when the president released his plan.

Opponents of the debt jubilee say the government is misusing the law, which was passed after the 9/11 terrorist attacks and provided relief to affected borrowers.

“It is not a blanket provision to get out of debt that an administration can invoke at will,” six Republican-led states wrote in their lawsuit against the plan.

Despite the grand scale of the president’s policy, the lawyer who argued on behalf of Biden’s tenure on the Supreme Court, Attorney General Elizabeth Prelogar, insisted that she was acting directly within the purview of the law to avoid the distress of borrowers during national emergencies.

“There hasn’t been a national emergency like this in as long as the Heroes Act has been on the books that has affected so many borrowers,” Prelogar said during oral arguments in late February. “And I think it’s not surprising to see in response to this once-in-a-century pandemic.”

A senior Department of Education official recently warned that resuming student loan bills without Biden’s loan payoff could trigger a historic spike in delinquencies and defaults. Those payments remain suspended due to a pandemic-era policy that began in March 2020.

THE QUESTION OF “LEGAL CAPACITY” COULD SAVE THE PLAN

The Biden administration’s pardon application had been open for less than a month when a series of legal changes forced them to close it. Biden’s plan has now faced at least six lawsuits from Republican-backed states and conservative groups.

Two of those legal challenges made it to the Supreme Court: one brought by six GOP-led states: Arkansas, Iowa, Kansas, Missouri, Nebraska, and South Carolina, and another backed by the Job Creators Network Foundation, a conservative advocacy organization. .

Some experts believe that judges could throw out lawsuits against the president’s plan because the plaintiffs failed to prove that the policy would harm them, which is often a requirement to obtain the right to sue.

The six GOP-led states argued that Biden’s loan forgiveness plan would be a financial setback for them because of a reduction in business among companies that service federal student loans in their states.

The court’s decision to hear arguments relatively quickly means it is likely to determine whether widespread loan cancellations are legal by the end of June.

They said the decline in revenue for MOHELA, or the Missouri Higher Education Loan Authority, could leave the agency unable to meet its financial obligations to Missouri.

In the second legal challenge backed by the Job Creators Network Foundation, lawyers argued that two plaintiffs, Myra Brown and Alexander Taylor, were deprived of their “procedural rights” by the Biden administration because it did not allow the public to formally intervene. in the form of his plan before implementing it. As a result, the lawyers say, Brown and Taylor were partially or completely excluded from the relief.

Elaine Parker, president of the Job Creators Network Foundation, insisted that her plaintiffs suffered damages from the policy.

“Had the administration gone through notices and comments as required by law, each could have made their case,” Parker said. “The show is a clear act of executive overreach.”

The Heroes Act, however, waives the need for a notice and comment period during national emergencies, Kantrowitz said. Also, not getting loan forgiveness or not getting as much as others is not the same as being hurt, he added.

“The Supreme Court is likely to be very critical of the circular arguments made by the plaintiffs in the JCN case,” Kantrowitz said. “You have to look at the law with crossed eyes to defend legitimacy.”

This article It was originally published in English by Annie Nova for our sister network CNBC.com. For more from CNBC enter here.