We are already going through the dynamics of a “mega inflation” regime, in the terms of the rigorous academic and researcher Juan Llach. This is a generalized and continuous increase in consumer prices of all goods and services at a combined annual rate of more than 100%. This extremely traumatic situation like the one that was already experienced from 1975 to 1991, including the 2 hyperinflations, already with 4-digit annual rates, of the years 1989/90; very burdensome duration and culmination those, which demonstrate how prolonged these painful processes can be.

In these cases, the entry into the aforementioned mega-inflation format is relatively fast, but then its transit and its outcome are always very complex, in terms of the serious social conflicts and the rupture of economic contracts that it causes, postponing production and private employment.

Currently, many of the conditions that ensure the sustainability of the aforementioned mega-inflation in the short and even in the medium term are present. First of all, a chronic primary fiscal deficit; second, your financing through monetary issue without demand for local money and with a high and growing level of rejection of the national currency; thirdly, an additional quasi-fiscal deficit of a superlative amount and a growing financial cost.

In addition, all this occurs in an electoral year of very harsh presidential political competition, with too many internal frictions and with the absence of dialogue and a basic understanding, between the government and the opposition, about the way out of the very critical situation. of public finances. If this general framework continues to operate, it could only result from even greater political and economic blunders.

Election year of a very tough presidential political competition, with too many internal frictions and with the absence of dialogue and basic understanding

It is thus realistic to expect a high probability of the continuation of this price dynamic in the coming months.

Given the low level of political messages that are still being heard, it is appropriate to believe that this current mega-inflation result is sustained by the successive blunders of excessive fiscal and monetary expansion committed, from an exclusive internal factory. Among them, the inconsistency of an economy with a current production of goods and services very similar to that of more than a decade ago, but that only in the last 3 years has brought its monetary base from $1.4 trillion to more than $4 trillion and their correlative remunerated public liabilities, from the National Treasury and the BCRA, from $1.2 trillion to almost $12 trillion.

It was impossible, despite the multiple traps, that internal prices did not finally begin to adjust these inconsistencies with the dynamics with which they are currently doing so.

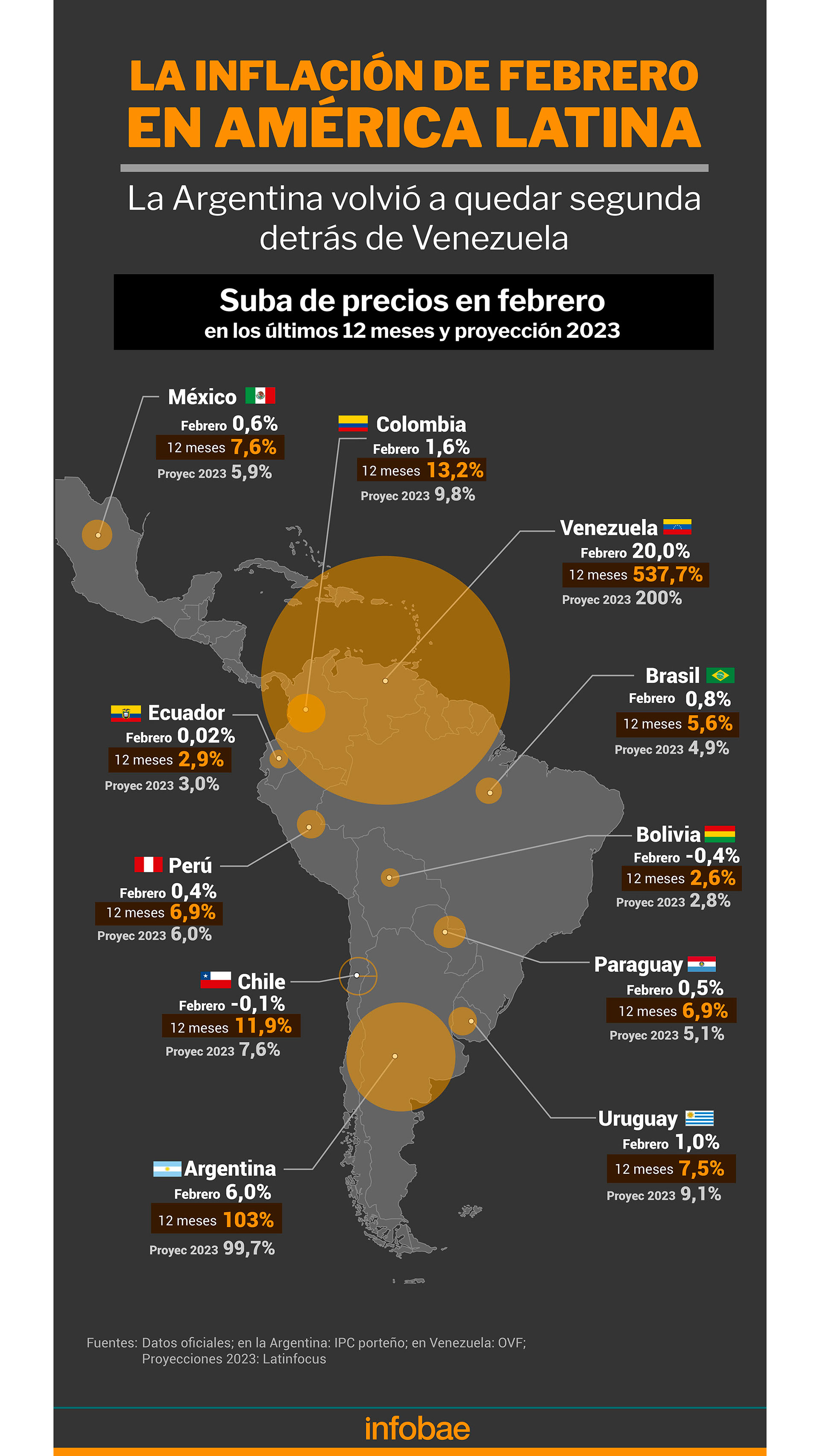

The mere relative comparison of the current annual inflation rate, above 100%, compared to the average, no longer global but of the rest of the countries of the South American region itself (except obviously Venezuela) of the order of 10%, given the same exogenous circumstances experienced (pandemic and quarantines, Russia’s invasion of Ukraine, climate change, etc.), exempts from any comment about the marginal incidence of these unforeseen exogenous events in the critical current local situation.

The high probability of facing an upcoming acute internal, economic and social circumstance makes it opportune to present the criterion that the domestic inflation rate should not be observed, from now on, only as a strictly quantitative variable, but should also simultaneously register to your qualitative profile, to establish an opinion about the current public policy.

This disaggregated observation, of amount and quality, of the next inflation rates would be relevant to sustain, or not, public credibility in a given course of the necessary process of cleaning up public finances that is faced; Therefore, they are the main responsible for the general imbalance of the economy as a whole.

An observation and a disaggregated analysis of the next inflation rates would then be necessary in the event of eventual and circumstantial price increases, in the form of transitory flashes, resulting from the necessary corrections of the so-called relative prices, today highly distorted and giving erroneous signals to any process of recovery of production and employment.

The political class as a whole should definitively absorb the majority academic consensus reached, both regarding the need for the autonomy of the BCRA and its priority objective of preserving the quality of the national currency as a reserve of economic value, as well as that the The core inflation component has a clear monetary origin. Therefore, the gradual reduction of that particular aggregate is one of the main monitors to watch.

The need for the autonomy of the BCRA and its priority objective of preserving the quality of the reserve of economic value of the national currency

Another very valuable lesson for the political class would be to understand, also definitively, that the regulatory frameworks of public services, arranged as monopolies for the convenience of society, due to their distribution in networks and the economies of scale that derive from it, They have not been created so that their rates are “trodden on” and prevent essential reinvestments, even when it could result in very attractive “political anchors” of temporary price stability; but they will always generate hidden and repressed inflation that, also always, will then have to be normalized, generating undesirable shocks of increases in internal relative prices.

In addition to the core inflation rate and that derived from regulated prices, there is a third component of the general index, caused by fluctuating seasonality, the rises and falls of prices in competitive markets for many goods and services.

Finally, you can even add the call inflationary inertia, which never results from the malice and greed of producers and merchants, but from uncertainty of all economic agents due to the lack of credibility in the political leadership of governments, in their stabilization programs (when these exist) and in the honesty and suitability of the main political officials and their technical teams (also when they exist).

Thus, similar amounts of inflation rates could, in reality, result from very dissimilar qualities. Not distinguishing them properly could be crucial to get out, or not, of the current path of decadence.

Keep reading: